Hi

We are testing Project Costing, and hope to roll it out in live in March.

The directors want us to play catch up on some closed sales orders and assign them to projects in Live.

I have checked in test and it seems ok to reopen a sales order, add a ProjectID to the lines and the project ID also flushes through to POs and invoices related to the sales order lines. So far, all good.

We don’t yet record labour in live, so we won’t need to try and add a project ID to any labour transactions belatedly.

However I may be tasked with adding the projectID to some closed expenses.

So far in test, this is going nowhere. Once an employee’s expense has had an AP invoice against it and they’ve been paid, i can’t recall the expense and add a projectID.

In our set up, an employee expense gets added to the Project as a material on the job in the WBS phase.

So I have tried to duplicate an expense as a material in a project job, e.g. hotel accommodation or mileage. In Project Entry > Project Costs, the amount of the expense not populates the Estimated ODC field, but I can’t get it into ‘actual’

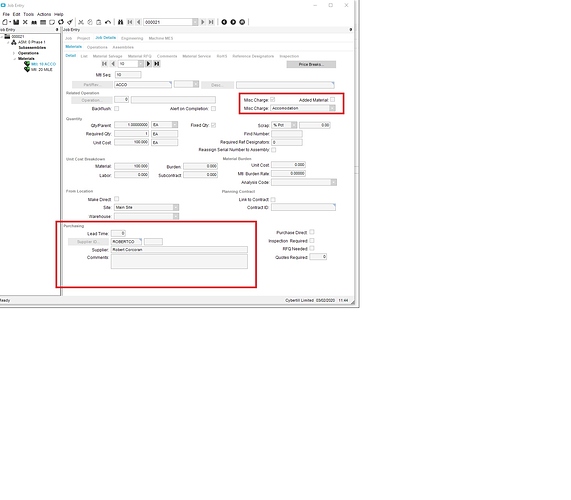

When I normally create an expense and tag a project ID, it becomes a material on a job, and

both ‘misc material’ is populated, and the supplier ID (the employee to be reimbursed).

A working example when project id is entered at the time of logging the expense, and the expense becomes a material on a job:

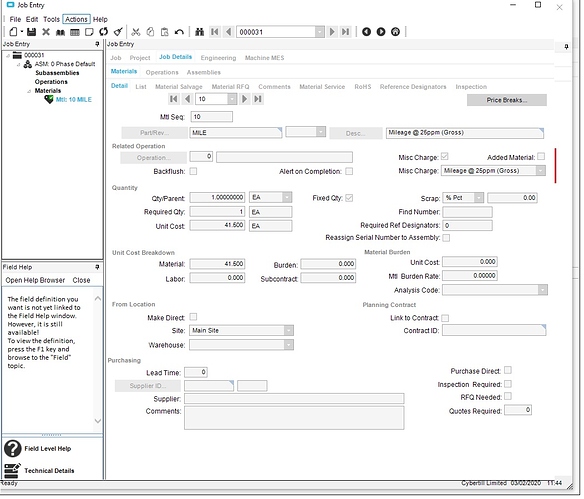

However, If I try to replicate this, because I can’t recall an expense to add the project ID to it, In Job entry > add material, If i tick misc material, the supplier field is greyed out and read only.

That’s kind of fine, as I don’t want to end up reimbursing the employee twice, but now it’s not the same.

So now, I have the material set up as an estimated cost but I can’t make it an actual cost on the project.

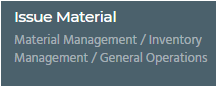

I tried ‘issue material’

and I can’t issue material this way, because it is a job miscellaneous charge

Business Layer Exception

Material is a job miscellaneous charge, cannot issue.

Exception caught in: Epicor.ServiceModel

Error Detail

Description: Material is a job miscellaneous charge, cannot issue.

Program: Erp.Services.BO.IssueReturn.dll

Method: OnChangingToJobSeq

Line Number: 7199

Column Number: 21

Table: IssueReturn

Client Stack Trace

at Epicor.ServiceModel.Channels.ImplBase`1.ShouldRethrowNonRetryableException(Exception ex, DataSet[] dataSets)

at Erp.Proxy.BO.IssueReturnImpl.OnChangingToJobSeq(Int32 piToJobSeq, IssueReturnDataSet ds)

at Erp.Adapters.IssueReturnAdapter.OnChangingToJobSeq(Int32 piToJobSeq)

So I try 'Issue Miscellaneous Material

And I can’t, because I have to pull in a part, and this is not a part in our part table.

How can I get a paid expense to belatedly record as a recognised cost in a project, or is not possible?

Thank you!