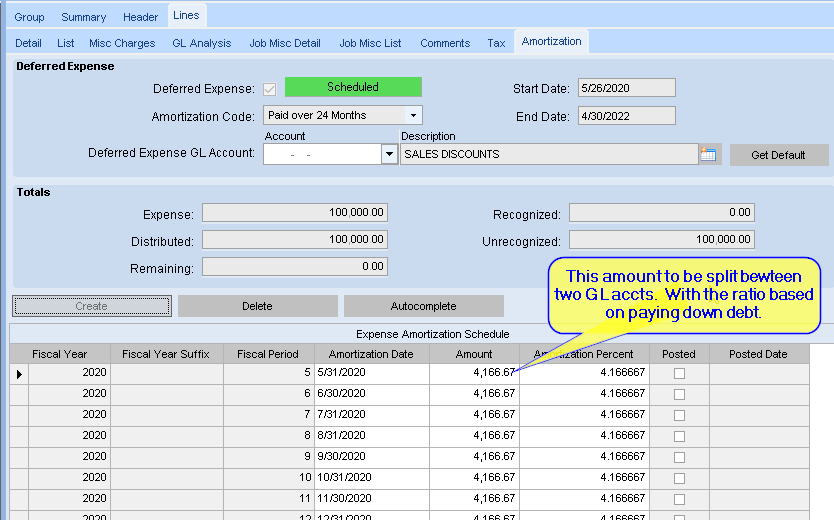

Anyone here have experience with deferred expenses? We have an amortization schedule for a loan where principal and interest change each month. I was hoping Epicor had the capability to amortize based on those variable values. Idea being that we could tell Epicor the loan amount, duration, and interest rate, and then it would post approximate principal and interest amounts each month. But it appears that the deferred expense/amortization code setup just takes the total loan amount and divides it evenly over a number of periods. Advice appreciated!

So what you really want is the Amortization process to be able to split each expense among two GL Accounts, One for Principle and one for Interest?

That correct?

Yes, that’s correct! We could even manually load the values instead of Epicor calculating, if what you described is possible.

You could make two lines on the Invoice. One for Principle and one for Interest.

After letting Epicor do its thing of splitting each equally among the number of payments, go back and update the Amotization Schedule

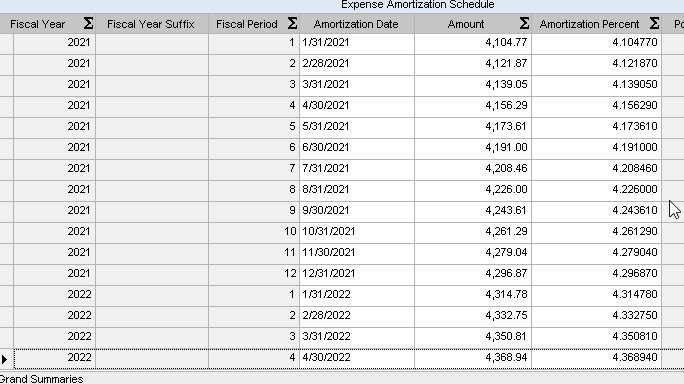

Here’s the Principle line’s Amort schedule updated:

I calculated the Amort schedule in Excel using the PPMT() and IPMT() functions. PPMT calc the Principle portion of a payment, and the IPMT the Interest Portion.

Wow, that is so clever! Taking base functionality (with what seemed like a missing feature) and making things possible  Thank you so much. I’ll report back if I find any flaws with this solution.

Thank you so much. I’ll report back if I find any flaws with this solution.

A couple of Hints…

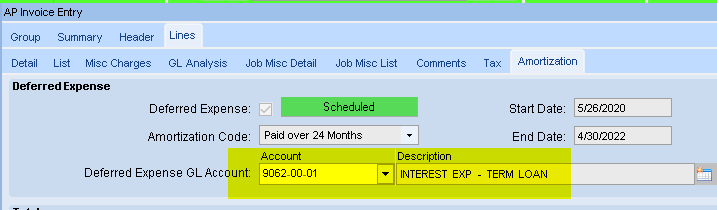

- You can set the GL Acct to use for each line. (each invoice line, not amortization line).

Here’s the test I dis for the Interest line:

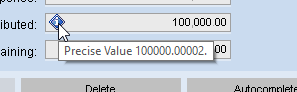

- Might need to do some rounding in excel, as pasting the raw values from PPMT() and IPMT() could lead to:

- Double check the results from PPMT and IPMT, those functions aren’t very straightforward