I’m sure I’m missing something, as duplicated GL Transactions are the #1 no-no. But …

We had a Shipment invoice (In Dec 2017) that incorrectly charged sales tax. So a Credit Memo was was created to reverse the 12/2017 invoice, and then a Misc Invoice created for the correct amount.

But it appears that the Misc Inv created the COGS transactions again, when the CM never reversed them.

The GL trans on the revenue side all appear correct, it just that GL Trans for the COGS were created again.

I’m basing this on querying the TranGLC table.

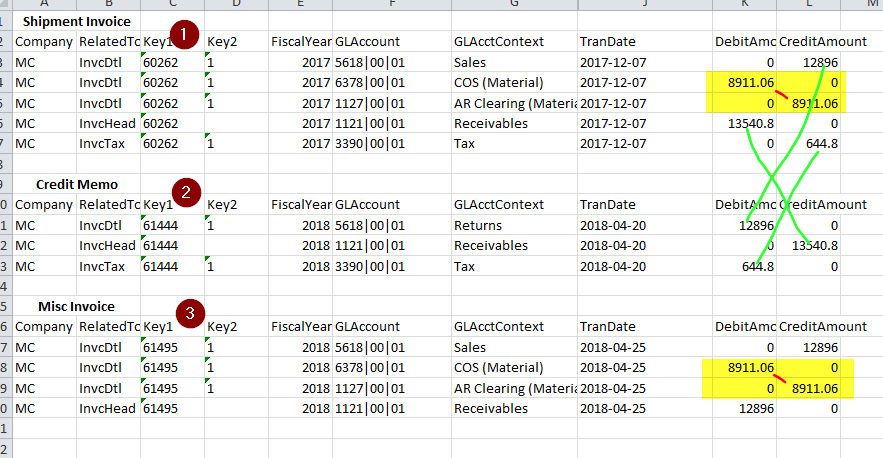

In the pict below,

(1) in the original Invoice based on a packer. You can see the costs moved from the AR Clearing Acct (1127-00-01) to the COGS (6378-00-01) for this Prod Group .

(2) in the Credit Memo. It reverses the Revenue related GL trans from (1) (green lines)

(3) in the subsequent Re-invoicing (a Misc invoice), and the AR Clearing to COGS shows up again.

Is this real, or just an artifact of the way I’m looking at it.