We are working through using the Transfer Order Process. We have set up several sites, and our goal is to move inventory from one site to another.

We use Average Costing. The “trick” is that we want the receiving site to use Standard Cost, and the inventory we transfer to the receiving site will be carried at zero value (this is customer used equipment we want to write off as used and quarantine away from our regular finished goods).

Everything works as we had hoped, EXCEPT the last entry Epicor makes when we receive the inventory at the receiving site is a credit to REVENUE and a debit to COGS for the value of the part. We have no clue why this is happening, figure I have missed something in the setup.

Below are my notes on the site setup process we used:

Site Creation Notes\Steps:

Go to Epicor \ System Setup \ Company\Site Maintenance \ Site Maintenance

Use NEW pull down and select NEW SITE

Fill in as much of the basic information as possible - time zone as example, for the most part leave everything as default (we will change Cost ID later)

Use NEW pull down and select NEW SITE GL CONTROL - Type = Division - Account = “where we want expenses to hit”

Go to Epicor \ System Setup \ Company\Site Maintenance \ Site Cost Maintenance

Use the NEW button create a new Cost ID —> be sure to link Primary SIte (but you will also need to do the next step!!!)

Go to Epicor \ System Setup \ Company\Site Maintenance \ Site Maintenance —> use the Action pulldown, Change Site Cost ID, set new ID we just created, DON’T forget to hit PROCESS (gears)

Go to Epicor \ System Setup \ Company\Site Maintenance \ Site Configuration \ —> Module tab \ Inventory Tab —> Serial # Tracking tab —> Set Serial Tracking Options to “Full Serial Tracking”

Go to Epicor \ System Setup \ Company\Site Maintenance \ Site Configuration \ —> Module tab \ Inventory Tab —> Serial # Tracking tab —> Set Lower Level Part Serial Tracking Options to “Full Serial Tracking”

Setup new warehouse under the Site - you will also need to setup at least one Bin in the new warehouse

PRIOR TO ANY TRANSACTIONS FOR EACH PART NUMBER

** Each Part we transfer into the new Site will need to be setup with the new Site, Warehouse and Bin

** For each part we intend to transfer, we will need to set the site cost to the appropriate method (note for UXAccess this is STD, and zero value to “expense” them on transfer)

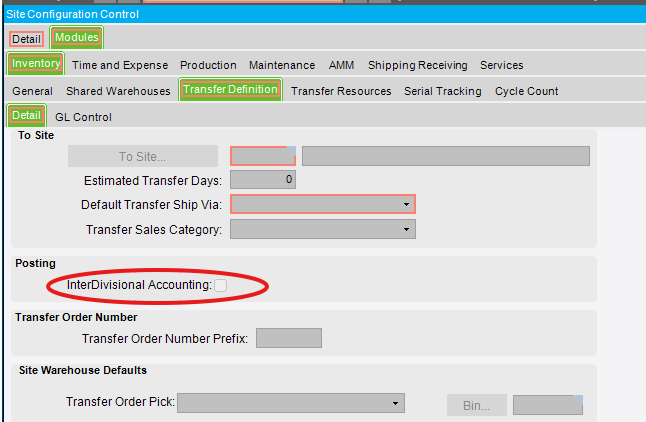

Need to setup GL Control Code for EACH site to guide STOCK TRANSFERS or PLANT TRANSFERS. Intra-Site Transfers for both “parking spots” for the transfer. The goal is a JE for both sites that removes the part from inventory on the first side and adds to inventory on the other side.