I see, nothing was mentioned about about transactions. I specifically asked if address validations costed anything and they said no, that’s covered in the cost of an invoice. I feel like the sales person was a bit shady. They quoted us a cost based on the number of invoices we produce per year, but from what you guys are saying it should probably be 3-5X that number…

I wouldn’t say shady they assume per invoice a set number of “transactions”. Let’s say it’s 3 per invoice so that’d cover address validation and tax estimates at the Quote & Order levels. Compared to the cost of having a dedicated employee responsible for just keeping up with the tax codes

and rates across all the states, counties, and local authorities Avalara is a bargain.

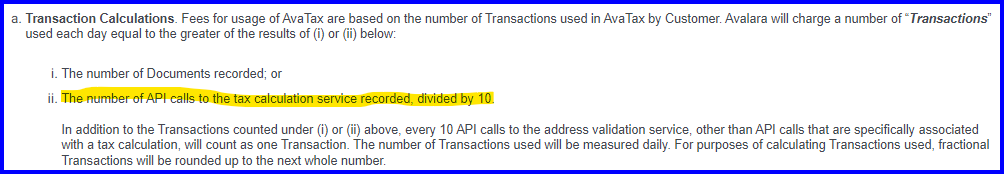

I suppose shady implies some level of malice, but its incompetent that they couldn’t have played the 2 minute video posted here or mentioned that “invoices” just means 10 API transactions. There was no way to know that having “ready to process” checked might rack up tons of charges for example, as I thought they literally meant you get charged per invoice not a less than transparent API call count. Especially when I asked if Address Validation incurred any charges.

Thankfully I am getting better information from people offering their time for free here ![]()

Unless you’re toggling “Ready to Process” on the same sales order multiple times I don’t see a big problem. Yes, they could be more clear that their quote included 15 API hits per invoice but their estimate to what we were charged was accurate. If you have a big growth year and are invoicing much higher than the number you gave them, they’ll let you know if you’re nearing your API level and can work out an overage or going to another tier.

Caveat emptor!

I’ve also heard somewhere… “And we’ve been poisoned by these fairy tales. The lawyers clean up all details.”

Another caveat is that as you are adding lines, it will make a call for each previous lines if you have ready to process checked (dumb tax laws necessitate this). That means if you are importing lines with say, paste insert, the calls being made will grow exponentially as you add lines. So make sure you don’t have ready to process checked until you are actually done with a large order. It causes other problems besides just the calls to avalara too, but is exacerbated by these calls.

We don’t set “Ready to Process” until after the order lines, shipto, etc is all done and order is ready to be released to manufacturing.

Is an API call made per Quote / Sales Order / Invoice line? Or per Quote / Order / Invoice?

If there’s a 100 line quote, which turns into an order, and then gets invoiced, is that 300 calls, which gets billed as 300/10 = 30 ‘invoices’?

If that’s the case, I can see why our Avalara bill is so huge!

If I look at the change log for the sales order header, you can see the amount grows with each line as Avalara adds tax.

Has anyone done reporting to help reconcile the Avalara statement against Epicor’s Quote/Order/Invoice history? We can total Q/O/I per month from Epicor, but it’d be interesting to audit and make sure it’s what we think it should be…

Right, even editing lines.

Real life story from this past Saturday:

- Ready-To-Process was ON/checked/true

- Edited a few releases - each one took 45 seconds to save

- Turned Ready-To-Process OFF/unchecked/false

- Edited a few releases - each one took 3 seconds to save

The order was 60 lines, I believe. So it validated all 60 every time until I turned off Ready-To-Process.

On that note:

Whoops! Definitely misunderstood this… Thanks for catching!

One big warning for new implementations. There is an option somewhere to do a Mass Address Validation - DON’T DO IT.

Our consultant (Epicor Professional Services) told us to validate all addresses, and that generated $4500 in junk fees. Avalara found all 8000 customers and 10,000 Ship-Tos in our database, and ran them through the USPS verification for no good reason. Most are never going to order anything ever, over half are international addresses that have absolutely possibility of validating with USPS. If you do address validation at the time of order one by one, the costs are insignificant.

Another caveat - if you happen to do a lot of International sales, Avalara will charge more junk fees to tell you that no sales tax is due when shipping out of country (Duh). The Epicor Professional Services did not think to tell us that. We eventually ended up using the Tax Liability field (aka TaxRegionCode) to ‘turn off Avalara’ for any customer that is not in USA.

About to go live. I’ve been asked to make it so they cannot generate the sales order confirmation report or turn the order into a job unless the ready to process flag has been set. Is there any setting for that or is that gonna be a bpm I have to make?

You’ll need a BPMs.

So we are having a huge problem, and I was wondering if anyone had any insight.

We have cert capture, and when our customers submit a exemption, it adds it as valid with no validation whatsoever. So the Tax ID can be completely blank, and it will accept it as a valid exemption.

However, Epicor sees no Tax ID, and so charges tax.

We go to Avalara for help on the lack of validation, and they say validating certs is up to us, everything is working as expected, and if we want any more help we need to pay for managed services.

wtf??

Even if the system can’t validate something it should put it into a queue for us to review or something. It seems like its completely broken and they are refusing to help. How does the Cert Capture work for you guys??

Hi @Evan_Purdy,

Are you certain that the reason that Epicor is charging tax is because it is not seeing a tax ID? I thought that Tax Connect just checked with AvaTax to see that it had a “valid” exemption certificate to cover the applicable ship-to region/jurisdiction/zone and did not check for an actual tax ID.

We no longer have access to the CertCapture system but rather must use the ECM features in AvaTax. Both have worked well for us and now that we finally upgraded to Kinetic, I’m looking forward to implementing the enhanced integration features.

We caved and are paying more for managed services, so they validate them.

Do you put the tax liability on the customer maintenance screen? And then the liability carries to the order header? How do you get the liability on the line so that it doesn’t go to Avalara at AR invoicing? Is that a manual process? We are looking at paying to automate but wanted to make sure there wasn’t functionality already built into the system. Thanks in advance.

Yes, it should work that way, but I think if the Ship To has a different liability that will override it. In the case where you just want to turn off AvaTax that should be fine.

Thanks, Evan. Your solution worked.