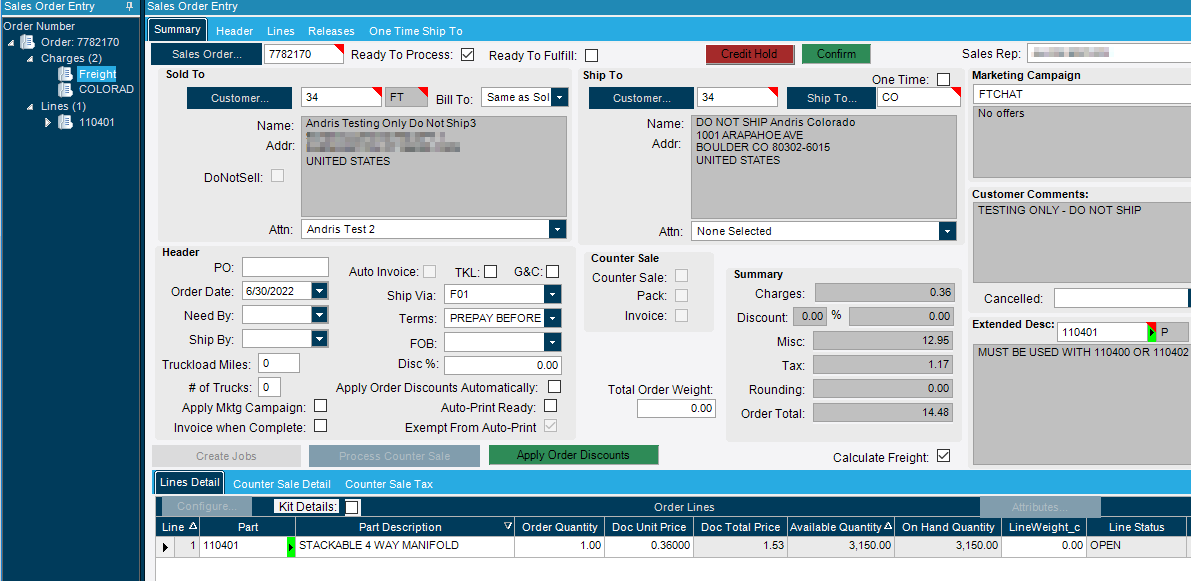

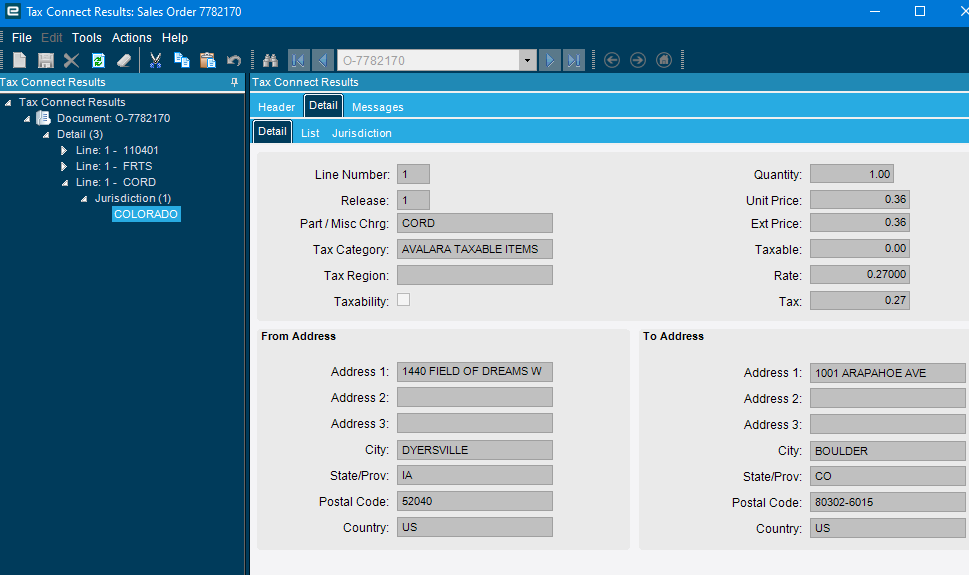

@Jonathan - Misc Header Charge amount was $0, and I left the ShipBy date blank. I thought that Avalara would add this to the tax when the CORD line was on the order.

Order date is June 30, it won’t calculate the fee unless its July 1st or later.

@Jonathan - Thank you! I didn’t realize Avalara used the Order Date field for the tax calcs. I changed it to 7/1, and it worked. Getting there!

This is a great idea! The fee works out to about $40 per year for us. Not worth spend thousands just to comply.

The problem in my opinion it isnt a quick BPM. First of all it depends if you want it on Order or if you want to simply add it during Customer Shipment Entry or Invoicing.

Let’s just assume in my case I want a Misc Charge on the Order.

- How are OTS handled

- How is Get From Quote Handled

- How is Converting a Quote to Order Handled

- How is Converting a Quote with OTS to Order Handled

- How are Bill To Alternates Handled

- If I pick a ShipTo for CO I want it Added, but If I made an oopsie and selected a different ShipTo I want it removed.

- Preventing the User from changing the amounts (Row Rules)

- Preventing the User from Deleting the Misc Charge or the #COLORADO-TAX Line Item

- Should the event happen on Ready to Process?

- How do I handle CM / Cancellations / Partial Invoices / Partial Shipments

- How do I handle Master Packs or Invoice Consolidations

- How do I handle Pre Payments etc…

- What about Drop Shipments…

- Do I do a Header Charge or Line Charges (Each Line could go with OTS somewhere else). Am I billing the ShipTo or based on BillTo…

- If I use the Actions → Copy Order and then Change Customer I want it removed (often people copy old orders as templates and change Customer)

- There is also the Get Historical Order (similar to copy).

- What about Customer is Picking up the Order (ShipVia Customer Pick Up)

- If you do Releases and have 100? Is Each Release a completed sale? or is it only complete when the Order is complete.

I have too many questions still. ![]() But if you are looking slim-dirty just a quick Charge Automation, not a big deal.

But if you are looking slim-dirty just a quick Charge Automation, not a big deal.

There are all these little things like if you do a Refund everything is refundable but this Colorado tax is not refundable. If you do Partial Invoices / Partial Shipments you shouldnt charge them again… its a one-time fee, regardless of invoices… If you fit 10 orders into 1 Truck, you charge them once, not 10x despite it being 10 orders (Consolidation).

We are still figuring out the flow and business process BEFORE we Automate. I suggest you all do it manually as well for the time being and figure the manual flow out first. RMAs, Cancellations, CM and Re-Invoicing, Partials yada yada.

I’d be happy to share my solution but that may be ways out.

It may be easier to add the charge during Invoicing because at that point its less likely to have changes. You can do Get Shipments, Get Drop Shipments etc…

Nice write up Haso.

I was wrong, it doesn’t say it has to be listed on the sales order, only that it has to be listed on the invoice. However, I don’t think Avalara will calculate the amount unless the part or misc charge is on the sales order. Is there a way to add the fee only at invoicing and still have avalara calculate the right amount?

Thought you all might like to see the latest Avalara blog post related to this !@#$%&* asinine legislation:

Colorado answers questions about new retail delivery fee

It’s been said that “laughter is the best medicine”, but sometimes primal scream therapy works too!!!

Ditto Utah. Thanks @hkeric.wci for adding more detail. It’s never as easy as it first seems, but I think the basic first step of adding the misc header charge CORD if shipto/OTS = CO and DocTotalTax > 0 and ReadyToProcess=true would take care of most cases. But how to do that efficiently so it doesn’t trigger the BPM to check every time the sales tax amount changes…

My thoughts on your questions:

#1. I guess it’s one more criteria looking at OrderHed.OTSState = CO.

#2. We’ve stopped using GetFrom Quote due to sales kit issues

#3. Using Quote Entry, Actions > Quote > Create Order adds the RDF misc charge automatically if it was on the quote.

#4. Haven’t tested.

#5. Should BillTo matter if it’s based on the ShipTo address (just like sales tax)?

#6. Removing if oops - that would be nice. I don’t know how frequently this would happen, and I’m ok with it as a phase 2 with having sales people remember to remove it manually for now. I think it’ll be a lot less frequent than needing to add it in the first place.

#7, 8: Preventing deletes & changes: Yes, that would be nice, but it’s more BPM’s or UI code to lock out changes or deletes. We are super sensitive to slowing down order entry right now, with the complaints we already have from our sales staff. For now, we’ll have to trust the sales team follow’s training

#9. ReadyToProcess: That’s a great idea, and would keep OrderEntry faster than checking it sooner in the process, and having the BPM’s fire multiple times.

#10. If it’s a misc header charge with a frequency of ‘FIRST’, it’ll get charged and invoiced once, no matter what. It doesn’t get refunded if the order was shipped. If it was cancelled and not shipped, AR would refund the order in full. If it hasn’t been shipped/invoiced yet, prepayments should be deposits, without sales actual tax liability. I’ll need to test, or just worry about this the first time it happens (yay! another EpiCare case!)

#11 & 13. I haven’t tested shipments, but don’t see why it would matter. It’s just a header charge that’s set to invoice on the first invoice. Another reason not to do a full part line that needs to be ‘shipped’.

#12. Prepayments shouldn’t matter. It’s just $ coming in to a deposit account that later gets reversed once the AR account gets hit when the shipment is invoiced. Need to test.

#14. I’d do a header charge. You just need one taxable line going to Colorado on the order for the RDF to apply. We’re lucky - Our business rarely has more than one shipto on an order - we’d split them into multiple orders. If you’ve got multiple shipto’s and OTS’s on one order, you’d have to crawl through it, and then add the RDF the first time it finds CO. Tax rates are typically based on the ShipTo address, which is the same in this case (using Avalara).

#15. Are they changing customers in SO Entry? Then #6 removing if oops should apply, no?

#16. Cool - something new! Never noticed that before. Looks like it adds lines to the order. If you’ve got the BPM’s firing once ReadyToProcess is checked (after the order is built), it should be checking if ShipTo/OTS = CO and tax > 0, and then adding the misc header charge.

#17. Nice one, didn’t think of that. Add a BPM condition in the start to exclude if Orderhed.CounterSale=false.

#18. The Colorado law says ‘Order’ so I’d take it on their word. Releases = more shipments on the same order, so no, it only applies once. They only get $.27 once, those greedy (&(^&%@##'s.

Add #19 - Check for zero dollar & non-taxable orders. The RDF doesn’t apply if sales tax doesn’t need to be collected.

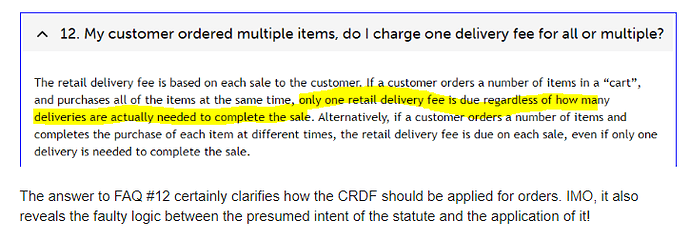

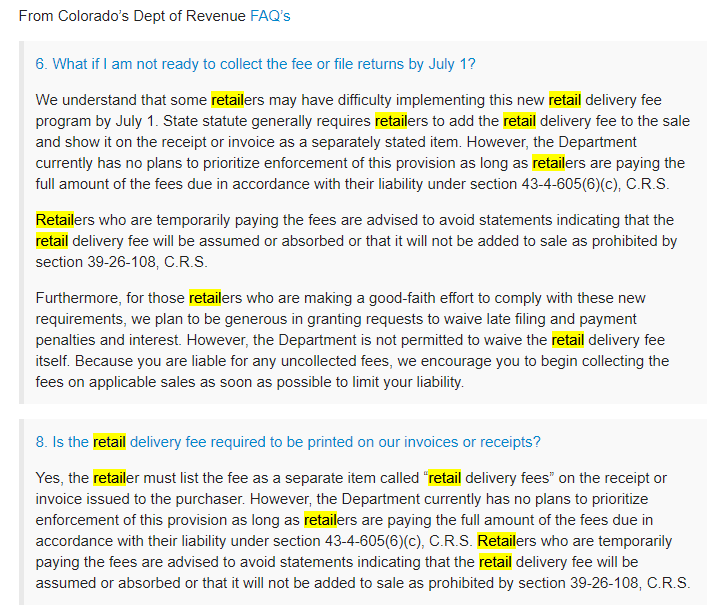

From Colorado’s Dept of Revenue FAQ’s

6. What if I am not ready to collect the fee or file returns by July 1?

We understand that some retailers may have difficulty implementing this new retail delivery fee program by July 1. State statute generally requires retailers to add the retail delivery fee to the sale and show it on the receipt or invoice as a separately stated item. However, the Department currently has no plans to prioritize enforcement of this provision as long as retailers are paying the full amount of the fees due in accordance with their liability under section 43-4-605(6)(c), C.R.S.

Retailers who are temporarily paying the fees are advised to avoid statements indicating that the retail delivery fee will be assumed or absorbed or that it will not be added to sale as prohibited by section 39-26-108, C.R.S.

Furthermore, for those retailers who are making a good-faith effort to comply with these new requirements, we plan to be generous in granting requests to waive late filing and payment penalties and interest. However, the Department is not permitted to waive the retail delivery fee itself. Because you are liable for any uncollected fees, we encourage you to begin collecting the fees on applicable sales as soon as possible to limit your liability.

8. Is the retail delivery fee required to be printed on our invoices or receipts?

Yes, the retailer must list the fee as a separate item called “retail delivery fees” on the receipt or invoice issued to the purchaser. However, the Department currently has no plans to prioritize enforcement of this provision as long as retailers are paying the full amount of the fees due in accordance with their liability under section 43-4-605(6)(c), C.R.S. Retailers who are temporarily paying the fees are advised to avoid statements indicating that the retail delivery fee will be assumed or absorbed or that it will not be added to sale as prohibited by section 39-26-108, C.R.S.

I was so aggravated that I forgot to call out one of the points in the blog post…

“Some home-rule governments may tax the retail delivery fee”

How about that for a kicker?!?

That’s our plan currently.

Wait it keeps saying Retailers? Does that exclude Manufacturers without a store-front? ![]() We mostly sell B2B not B2C

We mostly sell B2B not B2C

Siri define Retailer:

A retailer, or merchant, is an entity that sells goods such as clothing, groceries, or cars directly to consumers through various distribution channels with the goal of earning a profit. This merchant can operate in a physical building or online.

Retailers are the consumer-facing part of the supply chain, and most people interact with them frequently. They come in all different, types, styles, and sizes.

@hkeric.wci the tax loophole specialist! ![]()

If you’re B2B (and don’t have a taxable nexus for Colorado because all your customers are tax exempt since they’re the retailer), please crack a cold one for those of us who have to suffer for this ridiculous tax implementation method.

If you haven’t filed Colorado sales and use tax returns (I think you’d need to exceed $100k in Colorado sales), you get to pass go and collect $.27!

Did you see the new warning added to the KB article?

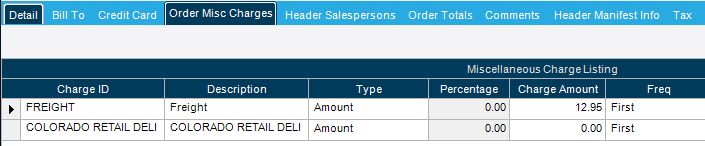

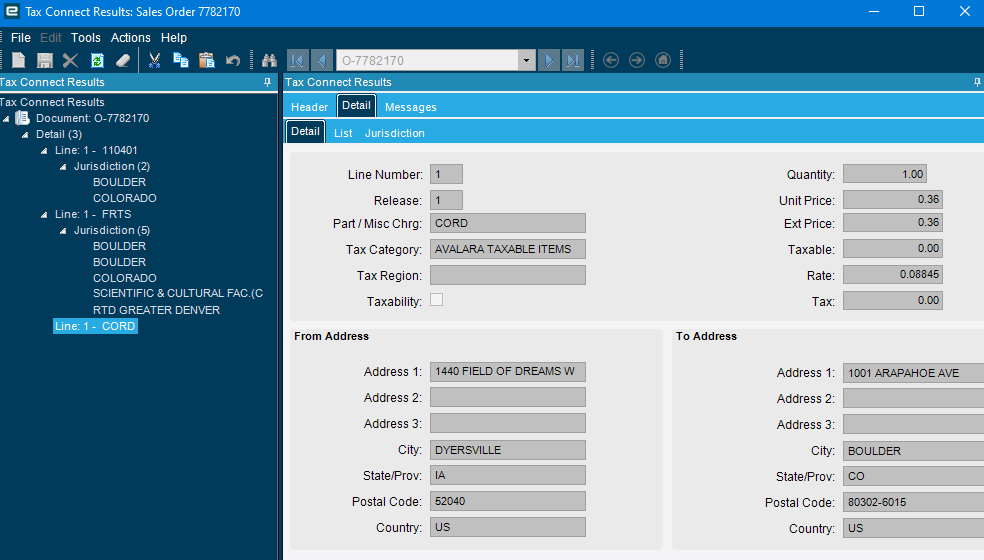

NOTE / WARNING: Although Avalara’s Help Center article mentions creating a part not a miscellaneous charge for the new fee, Avalara will also calculate the new fee/tax for miscellaneous charges. However, Epicor ERP 9, ERP 10, and Kinetic are not currently designed to break out and show the full, individual tax details for miscellaneous charges as occurs for parts. Due to this the miscellaneous charge method does not show a separate line and amount in the Taxes section of the Sales Order Acknowledgement form or of the AR Invoice form which does not satisfy the requirement mentioned in the above Avalara Help Center article which includes this text in the Overview section: “Retailers must separately state the retail delivery fee on all customer invoices and receipts.” If you choose to use a miscellaneous charge instead of a part to calculate the fee you accept the risk that your customers may short pay their invoices by the amounts of the new fee which could result in time and effort spent by your company to collect those amounts and/or to pay those amounts to the State of Colorado on their behalf.

Anybody who has not already complained about this to your Epicor and Avalara account managers, would you please contact them? I don’t think anything will be done unless they hear from more customers and this implementation is unworkable for us.

It doesn’t give a lot of details on how the fee must be noted on the reports, no specific wording, so the description for the misc charge could be enough.

It is not separated on the taxes because the taxes from the line and charges are kept under the same TaxCode in Erp.InvcTax.

I was wondering the same thing, Haso! You beat me to it!

I called Avalara directly to complain about this and their excuse for not properly supporting this is because its a fee not a tax.

Oh, okay, sure. ![]()

“What’s in a name? That which we call a rose by any other name would smell as sweet.”

And that which we call a fee, still a tax it surely be, and dost have a stench like ___! ![]()

(apologies to Shakespeare!)