When you run Received Not Invoiced Report, please run for longer range as there is a chance that report will miss some receipts. There are many occasion, Epicor does not mark as invoiced item as Invoiced in RcvDtl. You can write a BAQ by linking RcvDtl to APInvDtl and check it.

.

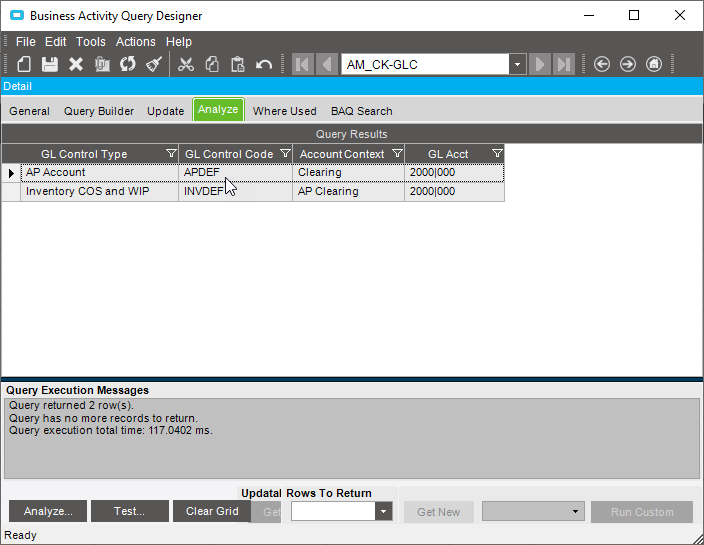

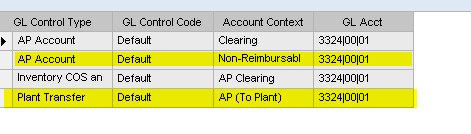

Below is the SQL script which I use for AP Clearing reconciliation if there is a problem. Please modify the company and AP reconciliation account.

WITH MyCTE AS (SELECT Erp.POHeader.Company, Erp.POHeader.OrderDate, Erp.PORel.PONum, Erp.POHeader.VendorNum, Erp.PORel.POLine, Erp.PORel.PORelNum, Erp.RcvDtl.PackSlip, Erp.RcvDtl.PackLine,

Erp.RcvDtl.ReceiptDate, ISNULL(SubQuery1.ReceiptAmt, 0) AS ReceiptAmt, ISNULL(SubQuery2.InvoiceAmt, 0) AS InvoiceAmt

FROM Erp.POHeader INNER JOIN

Erp.PORel ON Erp.PORel.Company = Erp.POHeader.Company AND Erp.PORel.PONum = Erp.POHeader.PONum INNER JOIN

Erp.RcvDtl ON Erp.RcvDtl.Company = Erp.PORel.Company AND Erp.RcvDtl.PONum = Erp.PORel.PONum AND Erp.RcvDtl.POLine = Erp.PORel.POLine AND

Erp.RcvDtl.PORelNum = Erp.PORel.PORelNum AND Erp.RcvDtl.ReceiptDate IS NOT NULL LEFT OUTER JOIN

(SELECT pt.Company, pt.PONum, pt.POLine, pt.PORelNum, pt.PackSlip, pt.PackLine, ISNULL(SUM(t.BookDebitAmount - t.BookCreditAmount), 0) AS ReceiptAmt

FROM Erp.PartTran AS pt INNER JOIN

Erp.TranGLC AS t WITH (NOLOCK) ON pt.Company = t.Company AND t.RelatedToFile = ‘PartTran’ AND CONVERT(VarChar, pt.SysTime) = t.Key2 AND CONVERT(VarChar, pt.TranNum)

= t.Key3 AND t.SegValue1 = ‘3000’

WHERE (pt.Company = ‘ABC’) AND (pt.PONum = pt.PONum) AND (pt.POLine = pt.POLine) AND (pt.PORelNum = pt.PORelNum)

GROUP BY pt.Company, pt.PONum, pt.POLine, pt.PORelNum, pt.PackSlip, pt.PackLine) AS SubQuery1 ON Erp.POHeader.Company = SubQuery1.Company AND

Erp.PORel.PONum = SubQuery1.PONum AND Erp.PORel.POLine = SubQuery1.POLine AND Erp.PORel.PORelNum = SubQuery1.PORelNum AND Erp.RcvDtl.PackSlip = SubQuery1.PackSlip AND

Erp.RcvDtl.PackLine = SubQuery1.PackLine LEFT OUTER JOIN

(SELECT AP.Company, AP.PONum, AP.POLine, AP.PORelNum, AP.PackSlip, AP.PackLine, ISNULL(SUM(t.BookDebitAmount - t.BookCreditAmount), 0) AS InvoiceAmt

FROM Erp.APInvDtl AS AP INNER JOIN

Erp.TranGLC AS t WITH (NOLOCK) ON AP.Company = t.Company AND t.RelatedToFile = ‘APInvExp’ AND CONVERT(VarChar, AP.VendorNum) = t.Key1 AND

AP.InvoiceNum = t.Key2 AND CONVERT(VarChar, AP.InvoiceLine) = t.Key3 AND t.SegValue1 = ‘3000’

WHERE (AP.Company = ‘MJ0001’) AND (AP.PONum = AP.PONum) AND (AP.POLine = AP.POLine) AND (AP.PORelNum = AP.PORelNum)

GROUP BY AP.Company, AP.PONum, AP.POLine, AP.PORelNum, AP.PackSlip, AP.PackLine) AS SubQuery2 ON Erp.POHeader.Company = SubQuery2.Company AND

Erp.PORel.PONum = SubQuery2.PONum AND Erp.PORel.POLine = SubQuery2.POLine AND Erp.PORel.PORelNum = SubQuery2.PORelNum AND Erp.RcvDtl.PackSlip = SubQuery2.PackSlip AND

Erp.RcvDtl.PackLine = SubQuery2.PackLine

WHERE (Erp.POHeader.Company = ‘ABC’) AND (Erp.POHeader.PONum > 0) AND (Erp.POHeader.OrderDate >= ‘2014-04-01’))

SELECT TOP (100) PERCENT Company, OrderDate, PONum, VendorNum, POLine, PORelNum, PackSlip, PackLine, ReceiptDate, ReceiptAmt, InvoiceAmt, ReceiptAmt + InvoiceAmt AS NetAmt

FROM MyCTE AS MyCTE_1

WHERE (ReceiptAmt + InvoiceAmt <> 0)