If you use Lot Average cost then you could set the cost for old lots to zero without affecting the cost of newer lots. That may be a bit easier than going the full FIFO costing route.

I am not sure how this works. From what I read, the Cost Adjustment form changes the cost for all parts on hand.

Just to clarify, we dont ever adjust the Part cost in epicor it is only an SSRS report that tells finance how to make the adjustment on the financial reports.

Lot Average keeps a different cost for each lot, so you can adjust each lot’s cost separately.

Of course, to do this, you must turn on lot tracking and then also use Lot Average cost method. When you use Lot Average, and if you receive to a new lot with every receipt, you essentially have an “actual lot cost” system. ie…

Day 1, you receive 10 parts to lot A at $1

Day 2, you receive 15 parts to lot b at $2

Day 3, you receive 5 parts to lot C at $3

On day four, you issue material from stock… it will ask you which lot. the cost that is consumed from stock will always be dependent on which lot you choose… if you need 12, the stockroom might choose to issue from lot B, which would cost $2 each.

We do track lots, but we use last costing. Lot Average sounds like a great option to me. But I am not in finance! ![]() Thanks for your feedback guys!

Thanks for your feedback guys!

Besides utilizing the reserve journal entry, and/or changing our costing method, are there any other common approaches to this problem?

We also use a reserve for this.

“Last cost” is typically the least recommended costing method. the logic of last cost does some behaviour that is not always intended, for example:

- 1000 parts received at $1 = GL now has $1000 in stock

- 1 additional part received but it was a sample, so it had a $0 value. Now your inventory value for the 1000 parts is zero. This caused a negative $1000 std cost variance to post

- again… another 1 part is received but this time, it was a $3 charge… now you have 1002 parts all set to $3, totaling $3006.

Each time you receive something at a last cost that is different from the previous last cost, all the inventory that is in stock gets adjusted in value. Most companies dont like this.

If you use AVERAGE, it does a WEIGHTED average of the receipts. There is no adjustment. These three transactions above would result in a final value of $1003 total, or $1.003 each per part. (assuming not using Lot Average)… if you are in Lot Average, then as long as you use a new lot number, the new cost would be specifically for that lot.

We have added a field into the PART table to mark OBSOLETE. have not censored these parts from the inventory reports yet, but we do a reserve adjustment in Accounting, so we may not change the reports.

Just curious, but why not use the canned “run out” check box? Not clear enough to users or are you using that function separate from obsoleting parts?

Run Out is for depletion of stock, but marking somehting obsolete is different. We have some customers that stop programs without notice and then parts are obsoleted.

You might want to check out Slow moving inventory and excess inventory reports in Inventory management.

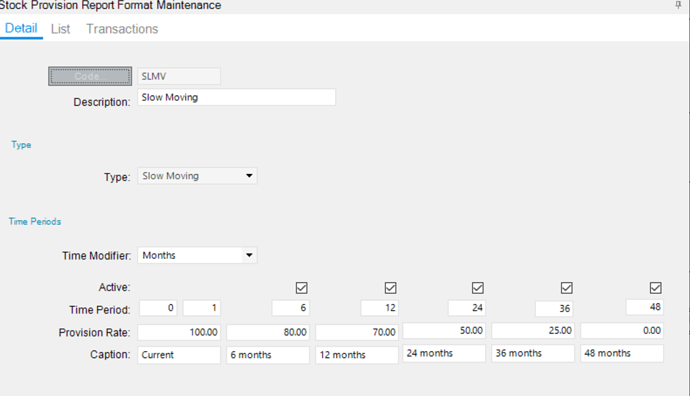

Make sure to first setup Stock Provisioning for the reports.

This way you leave the cost as is, but if there hasn’t been any movement for a while, the report will reflect your suggested value.

Slow Moving Stock Report_353164.pdf (253.5 KB)

From help…

Setting Up Stock Provision Reports

Article last updated: Yesterday at 20:00

You are an inventory manager. At the end of the year you need to calculate stock provision for excess inventory, slow moving inventory, and inventory that passed its due date and can no longer be sold at a regular price. In Kinetic you have the following reports that can help you: Excess Stock Provision Report, Slow Moving Stock Provision Report, and Obsolete Stock Report. However, before you run any of them, you need to define its settings. Do it in Stock Provision Report Format Maintenance.

Can anyone comment on this alternative approach? It seems like it will work. This would even allow us to arbitrarily move parts between warehouses if the need arises.

If you are truly going to have 2 different warehouses and store them differently then it might work.

If you are physically keeping the parts together, but virtually in separate warehouses it will end up causing problems. Im always against lying to the system.

Cycle counting is by Warehouse, so would would end up increasing your inventory when someone physically counts the actual number of parts in that bin.

You’re right! this could be tricky. Thankfully we store our parts in bins with lot labels along with other identifying information that should help us keep things separate.

Moving parts in the system is a lot of work

With lot control you could query last Parttran record by lot and part

Also filter by Trantype not including adj or STK-STK

This would allow finance to review parts based on usage

I agree with Bruce, doing this as a report would make more sense than doing actual inventory moves.

Did you mean a different table? PartTran?

Parttran

Darn mobile phone

MOST companies simply use the report as described and their Accounting dept does a journal entry to write off the overstock items to a reserve. This is self healing if items all of the sudden become of value again… no need to move inventory. Simply run the report, find out how much is excess, and change the reserve. I know that this technique was used decades ago by my CFO. We also kept a reserve for “overbuilds” when we had a job that was making more of our MTO product than the customer ordered (we had high scrap but sometimes we were successful at reducing scrap and so we produced too mch).