We are expensing our engineering time to our jobs, and I would like their applied labor to go to a “contra” GL account and not the standard applied labor account on the balance sheet. Our engineers are salaried employees. Currently I have a different shift and resource group set up for them. I am unsure of the hierarchy for WIP and COGS; is there a way a can set up a GL control on the employee record, shift, or?? to specify a different applied labor account?

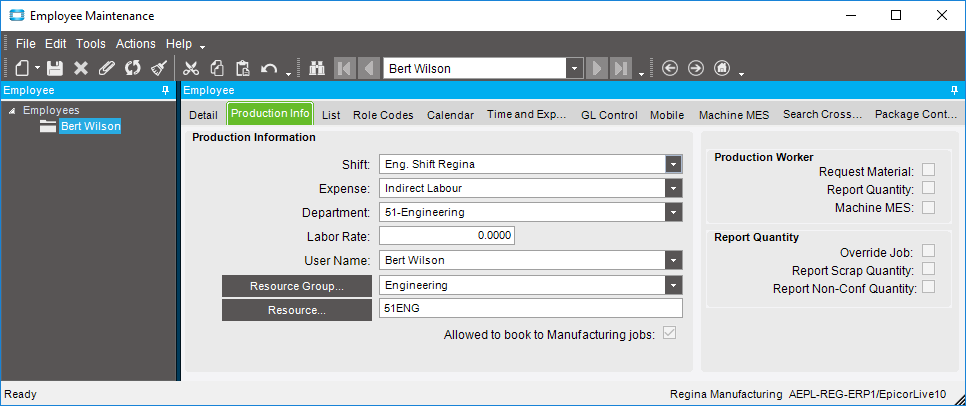

There is a labor expense field on the employee setup screen.

Do you have these employees setup for indirect expense instead of direct expense? If so check the GL account this is pointing to. If needed you could setup more of these with different accounts/

Brad

Screenshots below of current setup. Both need to be costed to the job but we need to see the expense separately.

Production Worker:

Engineer:

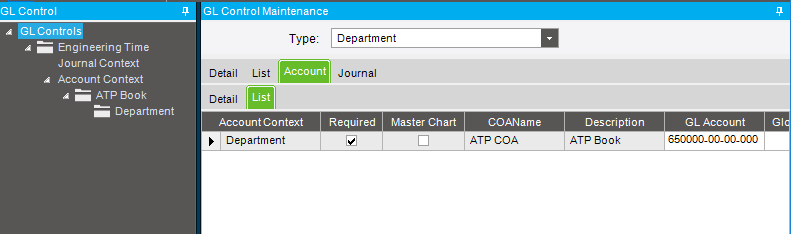

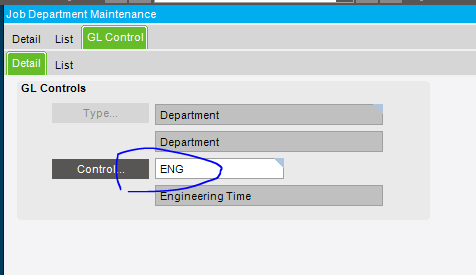

Ok, these two screens look to be pointed to the same indirect labor account. You could separate them by creating a GL code for the job department and tie that to a Eng GL department code.

That would let you use the same chart number for both types of labor but show the separation at the dept level.

Is that what you are looking for?

Brad

I will give that a try with our Finance lead and get back to you. Thanks!

Still not doing what Finance needs as it is still following the COGS. Here is a full explanation from them:

This is the employee to the job department level of GL Control and Codes.

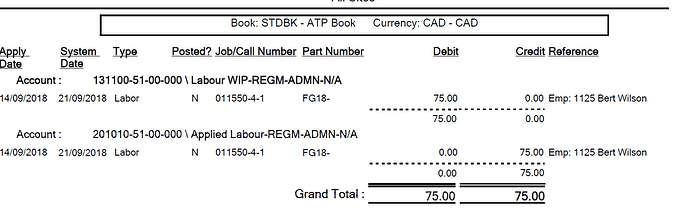

This is the WIP report: 1.5hours of time at $50.00

This is the path the system is defaulting to for WIP and Inventory transactions.

Ideally they would like to see the following in WIP, not just a debit transaction:

Debit 131100-51-00-000 75.00

Credit 650000-51-00-000 75.00

As I understand it, there is only one “applied labor” (Credit) GL account in the system. All the WIP is charged (debited) to the WIP Account specified in the Product Group GL Settings for the part being built on the job.

So… while you could have 10 product groups, each with their own WIP GL account, the applied labor will credited for the entire amount.

Thanks Tim - we were afraid of this but at least we know the limitation we are dealing with.

Is there any option of separating out the Applied Labor?

I notice on the Employee you can have a GL Control although there is no predefined Type assigned to this control.

Not without writing a bunch of posting rules.

And there has always been great debates as to the usefulness of this information if you were able to do it (even among Epicor Consultants).

The basic idea is that Applied burden is the credit account… the debit account DOES get charged out to the proper wip accounts for the product being made. THEN at Month/quarter/year end, the value of applied burden is balanced against ALL the charged burden (aka manufacturing overhead)…this can then be used to reset the burden rates so that the following period can apply the correct amount of burden. Example, if you “applied” $50k of burden, but your overhead was actually $100k, you need to double your burden rate.

Looking to revive this topic to see if it still holds true.

We have one base DL absorption account and one base Burden/OH absorption account. Added to those base account are multiple permutations of departments.

However, I am now being tasked with splitting for example the DL absorption (aka applied labor) to credit to two different base accounts (aka natural account segment) depending on the resource group that is applying labor. I am flummoxed as how I can do this.

If what I am asking is the same as the above, then does Shuwy’s answer still hold true? That it is not part of base functionality, and we’d need would need special posting rules.